Introduction: The Missed Opportunity

I have been deeply involved in cross-border trade and exports for over two decades—first as an exporter-importer in engineering goods, then as Wayfair Asia’s head, and now at Warpfy, where we are working to take Indian home goods global at scale. Over the years, I have seen a flood of commentary on India’s export potential—often filled with broad, uninformed chest-thumping but lacking tangible insights on why we consistently fail to capture the opportunity.

Between 2018-2021, as I built Wayfair’s International Supply Chain, China’s share of our origin volume fell from 85% to 65%. Where did the China+1 shift go? Vietnam, then Indonesia & Malaysia. India? Nowhere. In 2024, I have met numerous small ($5M-$50M) brands that attempted to source from India—only to face the same hurdles and walk away. This experience was a key driver for starting Warpfy in 2021.

So why is India failing to scale in categories where it should have an advantage?

Baseline: India’s Weak Position in Finished Goods and B2C Exports

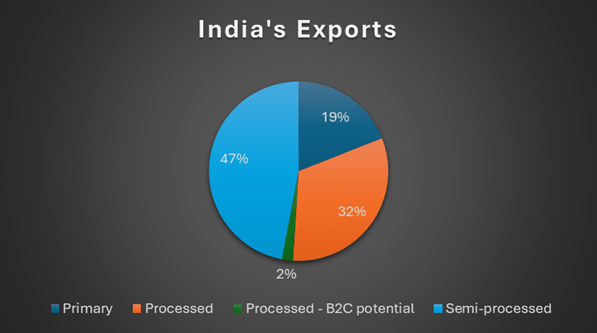

- Over 70% of India’s exports are raw materials and intermediate goods.

- Less than 2% of India’s exports fall into finished B2C categories with branding potential.

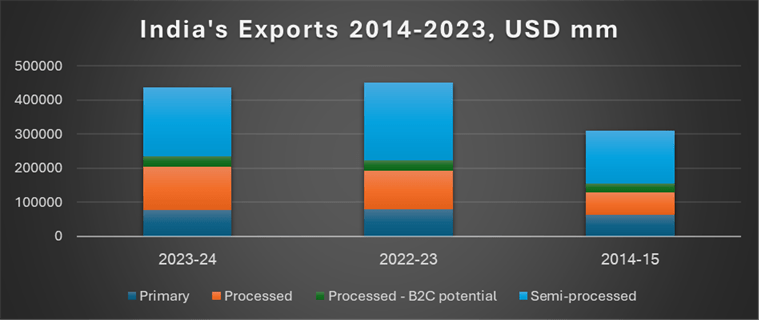

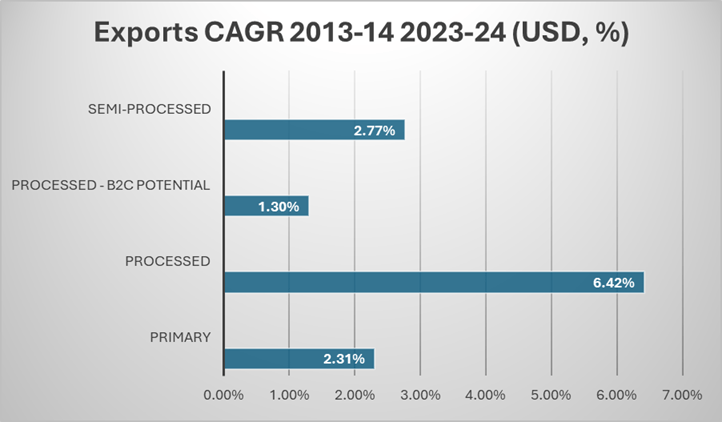

- Between FY 2014-15 and FY 2023-24, India’s exports grew by just 3.5% CAGR, a mediocre performance.

- Finished goods exports, particularly B2C categories, grew the slowest at barely 1% CAGR.

- Apparel and accessories—India’s largest finished goods export—declined 15% over the past decade.

- Furniture exports grew from $10B to $20B over 10 years, but Vietnam surged from $5B to $50B in the same period.

- Coffee, tea, and spices grew at just 5% CAGR, despite strong B2C potential.

Key Barriers to India’s Value Add Finished Goods Export Growth

1. Trust Deficit: The Invisible Cost

India’s export ecosystem is trapped in a vicious cycle of mistrust:

- Businesses do not trust government officials or other businesses.

- The government does not trust businesses, leading to excessive bureaucracy and inefficient policies.

- Buyers do not trust Indian exporters due to inconsistent quality, unreliable timelines, and lack of global-scale brands.

- Numerous intermediaries (buying houses, sourcing agents) act as “trust brokers,” increasing costs.

Comparison:

- A buyer can seamlessly place an order with a Chinese or Vietnamese supplier on Alibaba without letters of credit (LCs) or excessive documentation.

- Attempting the same with an Indian exporter is a Six Flags-level rollercoaster of uncertainty, missed deadlines, and quality concerns.

2. Structural Short Termism

Government policies often prioritize short-term fixes over long-term growth:

- Import duties on raw materials (e.g., steel) protect local suppliers but cripple downstream industries.

- Section 43B(h) mandates payments to MSE suppliers within 45 days, straining exporters’ cash flows.

- Credit and financing remain inaccessible to B2C exporters.

3. Human Capital Deficit: The Productivity Drag

India’s workforce productivity is far below global standards due to:

- Low automation levels

- Insufficient skill development

- Fragmented, subscale operations

- High absenteeism and long holiday cycles

4. High Logistics Costs & Inefficiencies

- India’s inland logistics costs are 2-3x that of Vietnam & China.

- Port congestion & excessive documentation add unnecessary delays.

- Lack of consolidation hubs forces buyers to coordinate with scattered, small-scale suppliers.

5. Weak Global Branding & Market Access

India excels at manufacturing, but its firms struggle with global sales, marketing, and distribution. Unlike Korean skincare or Japanese engineering, “Made in India” lacks global brand recognition.

6. Financial Constraints & Working Capital Gaps

- Indian exporters face cash flow crunches due to long credit cycles and high capital costs.

- No structured invoice-backed financing for SMEs looking to expand.

Tactical Path to Ensure Next Decade is not another Missed Opportunity

1. Trust Deficit Solution: India Export Bureau (IEB) – A Trust-Driven System

- Modeled after the Better Business Bureau (BBB), IEB would rate Indian exporters based on:

- On-time delivery (measured against purchase order ship dates)

- Quality adherence (evaluated via buyer feedback and shipping bill checks)

- Contract compliance (to prevent quantity short-shipping)

- Exporters with poor ratings face penalties, such as withheld GST refunds and duty drawbacks.

- Top-rated exporters gain easier access to capital, preferential tax treatment, and global trust.

- IEB will be funded by all the councils such as EPCH, CEPC, AEPC, HEPC, etc.

2. Structural Short Termism Solution: Play the Long Game

- Remove import duties on critical raw materials like steel, offsetting losses with local subsidies, levelling the playing field for downstream industries. The government will also reap the windfall many times over in export duties + domestic GST vs. the paltry loss of import duties.

- Extend invoice-backed financing schemes to B2C exporters to improve cash flow.

- Develop fully integrated B2C export hubs (like Shenzhen, Yiwu) with world-class infrastructure.

3. Human Capital Deficit Solution: Strategic Hiring & Upskilling

Knowledge transfer has been key to successfully bridging India’s skill gap allowing it to jumpstart and rapidly accelerate value add industries such as automotive, auto ancillary, pharmaceutical. We need to empower finished goods sectors to leapfrog similarly.

- Create talent / skill based 6–24-month special visas for Indian manufacturers to higher mid-level talent from China and Vietnam to transfer skills to Indian manufacturers.

- B2C-focused industrial training programs to rapidly upskill the workforce.

- International collaboration with firms in Vietnam, Korea, and Malaysia to transfer knowledge.

4. High Logistics Costs & Inefficiencies Solution: Export-Oriented Logistics Hubs

- Accelerate Shenzhen-style export hubs integrating logistics, marketing, and support services.

- Establish plug-and-play manufacturing parks for exporters with built-in compliance support.

- Digitize & streamline customs processes to reduce clearance times by 50%.

5. Weak Global Branding & Market Access

India excels at manufacturing, but its firms struggle with global sales, marketing, and distribution. Unlike Korean skincare or Japanese engineering, “Made in India” lacks global brand recognition.

Solution: Government & Private Sector Push

- Export Marketing Incubators to train exporters in global branding, pricing, and sales strategies.

- Soft Loans for Market Entry: Government-backed credit to help SMEs establish international distribution.

- Build upon Targeted B2C Trade Shows & Delegations: India should aggressively promote brands at major global expos like Ambiente, Maison & Objet, and High Point Market.

6. Financial Constraints & Working Capital Gaps

- Expand invoice factoring schemes to improve exporter liquidity.

- Bureau-linked benefits: Top-rated exporters (as per IEB) receive priority access to low-cost capital.

- Loss-of-Income Insurance: Government should offer export risk insurance based on past performance.

Conclusion: India’s Exporters Must Step Up

India’s B2C export stagnation is not just a government problem—businesses must step up too:

- Stop looking for excuses.

- Reinvest profits into business growth, not just land speculation.

- Adopt mass-production efficiency without romanticizing inefficient “artisanal” production.

- Collaborate with fellow exporters to go direct-to-importers and bypass unnecessary intermediaries.

India is at a crossroads. The world is actively diversifying away from China, and this window will not stay open forever. Either we seize the moment with bold, structural changes—or we remain an also-ran in global trade.

Call to Action

While considerable action is evident in select value add sectors, such as phones, most finished goods segments are ailing.

while India has initiated various programs to tackle these challenges, the performance and impact of these initiatives vary across sectors. How can we be more agile to rapidly execute initiatives, and pivot based on success or failure.

This article is meant to spark debate and action. If you are an exporter, investor, policymaker, or stakeholder in India’s trade ecosystem—what are your thoughts? Let us build solutions together.